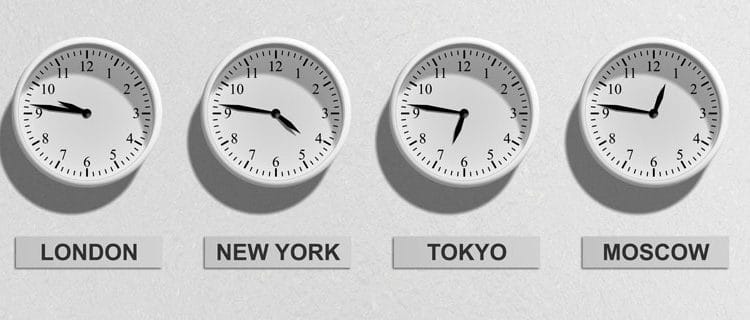

Forex Trading Hours Clock – Trading Sessions

Forex Trading Hours Clock | Stock Market Hours

Now that you know what forex is, why you should trade it, and who makes up the forex market, it’s about time you to learn when you can trade and the different forex trading sessions.

Yes, it is true that the forex market is open 24 hours a day, but that doesn’t mean it’s always active the entire day. You can make money trading when the market moves up, and you can even make money when the market moves down. But you will have a very difficult time trying to make money when the market doesn’t move at all. And believe us, there will be times when the market is as still as the victims of Medusa.

This article will help determine when the best times of the day are to trade.

Get More :

Winter Forex Trading Hours (October – April)

| Time Zone | GMT | EST Time |

| Sydney Opening | 9:00 PM | 4:00 PM |

| Sydney Closing | 6:00 AM | 1:00 AM |

| Tokyo Opening | 11:00 PM | 6:00 PM |

| Tokyo Closing | 8:00 AM | 3:00 AM |

| London Opening | 8:00 AM | 3:00 AM |

| London Closing | 5:00 PM | 12:00 PM |

| New York Opening | 1:00 PM | 8:00 AM |

| New York Closing | 10:00 PM | 5:00 PM |

Summer Winter Forex Trading Hours (April – October)

| Time Zone | GMT | EST Time |

| Sydney Opening | 10:00 PM | 6:00 PM |

| Sydney Closing | 7:00 AM | 3:00 AM |

| Tokyo Opening | 11:00 PM | 7:00 PM |

| Tokyo Closing | 8:00 AM | 4:00 AM |

| London Opening | 7:00 AM | 3:00 AM |

| London Closing | 4:00 PM | 12:00 PM |

| New York Opening | 12:00 PM | 8:00 AM |

| New York Closing | 9:00 PM | 5:00 PM |

Forex Market Hours Trading Sessions

A trading session is a period when banks and other market participants trade actively. The forex market works round the clock from Monday to Friday. When night falls in one part of the globe and the local market shifts into a sleeping mode, the sun rises in the other part of the planet, and trades start there. This process is non-stop, so traders can work at any time they want. The exception is the weekends and international holidays such as Christmas, New Year’s Eve, and Easter. These days, the currency market is closed.

You can improve your performance if you know the forex trading hours. During certain trading sessions, the volatility in the currency market increases, and good opportunities for entering the market and profiting from the price fluctuations may arise. When trading sessions overlap, i.e., one session remains open while another one starts, the trade volume peaks out, and the volatility surges, which is an advantageous condition for traders.

Different Trading Sessions And Their Characteristics

At night, quotes usually move slowly, while in the daytime, the volatility increases sharply. Forex trading sessions differ by working hours and trade peculiarities. Every session can be characterized by the most traded currency, the volatility level, and the degree of impact of fundamental factors.

#1. Pacific Trading Session

The work on the currency market starts with the opening of the Pacific trading session, the calmest one. No sharp fluctuations are usually seen here. As a rule, prices barely move, the market stands still, and the currency quotes trade sideways during the Pacific session. Professional traders tend to avoid opening deals in this period, but they continue monitoring the market movements, watching for a break of some key psychological or historical levels, the formation of a new trend, or price reversals.

For newbies, it is the most suitable period for learning and making their first deals as the risk is minimal. Besides, some automated trading systems that are adjusted for flat trading can prove to be efficient during the Pacific session. However, there can be some periods of heightened volatility when the US Federal Reserve System announces the results of its regular policy meeting. The immediate reaction to these announcements can be rather sharp so that it can have a significant impact on the price dynamics.

AUD/USD and NZD/USD are the currency pairs that are most often traded during the Pacific session. It is so because the Australian and New Zealand dollars are the national currencies of the Pacific region states.

#2. Asian Trading Hours Session

At the opening of the Asian trading session, the market comes to life, and currency quotes start moving faster. The intense activity is usually seen in the early hours of the session when key macroeconomic reports are published. At this time, Japan, Australia, and New Zealand often deliver their statistics.

The EUR/JPY, USD/JPY, and AUD currency pairs are the most active ones in the Asian session. The EUR/USD pair is worth special attention as it is volatile in any trading session. Statistically, when the pair demonstrates sharp fluctuations in the American session, it usually consolidates in the Asian session.

The liquidity is usually low during the Asian session. Most currency pairs trade in narrow ranges preparing for stronger movements in the subsequent trading hours. The Asian stock exchanges often set the trend for the rest of a trading day.

The market is moderately volatile so that any trading style can be applied here. Given the unhurried pace of the price movements, traders act similar to hunters. They have to wait long and patiently for their prey, but a fine shot can bring decent profits.

#3. European Trading Hours Session

The European trading session is the most lively and eventful one. The trade volumes here are large, so the trading activity is heightened. Mostly, sustainable trends on the market are formed during the European session. Traders need to bear in mind this fact. Besides, false signals are frequent in this period, as the European dealers test the market, try to find the congestion of stop orders, and spot support and resistance levels.

The beginning of the session is usually calm, and the price movements speed up at the opening of the London Stock Exchange. It is the traders’ favorite period, as the volatility is high, and EUR, USD, and GBP pairs are most actively traded.

The peak of activity is usually seen in early and late hours, while in the afternoon, traders take a short break. The price trends usually change at the end of the session.

Any currency pair can be traded during the European session, but most often traders open deals with EUR/USD, GBP/USD, USD/JPY, and USD/CHF pairs as well as EUR/JPY and GBP/JPY cross rates.

Experienced traders like the European session as it can provide ample opportunities for reaping hefty profits. An ability to analyze a large amount of information and define the market tendencies promptly can yield generous gains.

#4. American Forex Trading Hours Session

An outburst of trading activity is usually witnessed during the American trading session, involving huge sums and captivating the attention of millions of traders around the world. It is the most aggressive, unpredictable, and potentially profitable trading session. Market participants largely focus on the release of the news that often causes mixed and chaotic currency movements. The price trends that are formed in the European session can either continue or reverse during the American session.

Geographically, the American session covers not only the United States but also in Canada and Brazil. Traders pay special attention to USD and CAD currency pairs. Besides, JPY pairs also become highly volatile in this period. Those market participants who are not afraid of sharp swings open deals on such cross-rates as GBP/JPY and GBP/CHF.

There is one more essential aspect. It is no secret that the European banks are as influential as the American banks, so the first ones partially offset the importance of the latter. Therefore, the highest volatility is observed when the European session closes, and the US banks get the ultimate power.

The activity in the US market decreases by Friday evening. Traders usually fix their profits before the weekends that is followed by a pullback of the major trends.

Worst Times to Trade

- Sundays – everyone is sleeping or enjoying their weekend!

- Fridays – liquidity dies down during the latter part of the U.S. session.

- Holidays – everybody is taking a break.

- Major news events – you don’t want to get whipsawed!

- When you just broke up with your significant other because you chose trading forex over him or her.

Managing Your Time Wisely

Unless you’re Edward Cullen, who does not sleep, there is no way you can trade all sessions. Even if you could, why would you?

While the forex market is open 24 hours daily, it doesn’t mean that action happens all the time! Besides, sleep is an integral part of a healthy lifestyle!

You need sleep to recharge and have energy so that you can do even the most mundane tasks like mowing the lawn, talking to your spouse, taking the dog for a walk, or organizing your stamp collection.

You’ll need your rest if you plan on becoming a hotshot currency trader.

Every trader should learn when to trade. Scratch that. Every trader should know when to trade and when not to trade. Knowing the optimal times, you should trade and the times when you should sit out and just play some Fortnite instead.

What are your best trading times? Share your thoughts with us using the comment box below.

magnificent publish, very informative. I’m wondering why the opposite specialists of this sector don’t realize this. You must proceed your writing. I am confident, you have a huge readers’ base already!

It’s very easy to find out any topic on web as compared to books, as I found this paragraph at this site.